S&P Global Market Intelligence recently published 2024 Trends in Fintech, revealing that the new year brings a more focused, disciplined, and deliberate way of allocating fintech resources.

“Fintechs globally raised $46 billion in venture funding between Q3 2022 and Q3 2023. That figure stands in stark contrast to the $119 billion raised in the heady days between Q2 2021 and Q2 2022. With the “fast growth fueled by cheap capital” era of fintech now firmly in the rearview mirror, 2023 has been marked by rightsizing and a recommitment to business fundamentals across the sector.” – S&P Global Market Intelligence 451 Research.

With a fresh perspective on long-term sustainable growth for 2024, the new year will bring a “return to business” targeting financial services initiatives that are occurring within banks and enterprises. Infrastructure-oriented fintechs, specifically those in payments and regulation technology (regtech) — are positioned advantageously as they will help drive operational efficiencies for customers.

Some additional insights for 2024:

A refresh of Point-of-Sale terminals

There is a tremendous promise of growth at the point of sale (POS) in the United States, due to the impending wave of POS terminal upgrades driven by the EMV liability shift in 2015. This trend is further boosted by PCI DSS 4.0, which mandates new payment data security requirements by 2025.

The EMV liability shift that went into effect in October 2015 – which required merchants to upgrade their POS terminals to devices compatible with EMV chips or else bear responsibility for any fraud losses – sparked an unprecedented wave of hardware refreshes across the country.

Now that these terminals are near end of life, many merchants will be considering purchasing new terminals, especially due to the focus on PCI DSS 4.0, which mandates new payment data security requirements by 2025.

Bank payment modernization

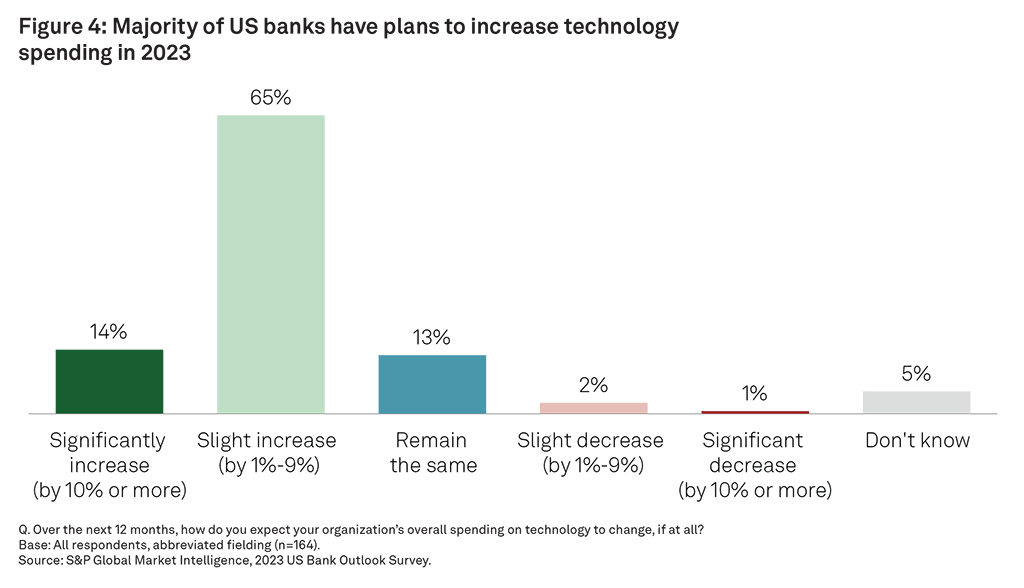

Despite the slowing economy, banks don’t plan to pull back on technology spending, in particular, technology that modernizes payments systems of incumbent financial institutions.

Banks are continuing to adopt a progressive approach to decoupling their payments systems from legacy core banking systems instead of ripping and replacing the incumbent applications. Vendors offering componentized, cloud-native offerings that work alongside cores are well-positioned to help banks navigate this complex landscape. – page 8

Modern alternatives for traditional payments

This trend predicts that fintechs could push real-time payments beyond peer-to-peer transfers and into a more complex realm of digital commerce and cross-border payments.

Fintechs of various types seek direct or indirect access to instant payment systems to create alternative payment rails that may bring more favorable economics to merchants and small businesses. Open banking players will increasingly push for embedding instant payments on the checkout pages of merchant websites. – page 8 of report

B2B Payment Innovation

B2B Payment Innovation

About 46% of SMBs agree that their business relies too much on manual, non-automated processes for managing financial and payment tasks. Therefore business-to-business (B2B) payments will take center stage as the “final frontier” for payments innovation. With significant inefficiencies in B2B payments, the market presents opportunities for fintechs to address these challenges and streamline processes.

Regulation Technology

Increasing regulatory burden has caused fintechs to look to outside vendors to support them in remaining compliant and reducing the operational burden of global compliance requirements.

The increasing prevalence of fraud, in addition to the ever-present risks of money laundering and terrorism financing, means that more and more fintechs are enlisting specialist vendors to help them tighten up their onboarding and know-your-customer processes, and to support them in ongoing transaction monitoring to ensure identification and crack down on suspicious behavior, helping other players in the financial services ecosystem to automate processes that have until now been manual. – page 11

Payment Globalization

With “borderless commerce” becoming more prevalent, many fintechs will focus on international expansion, leading to increased partnership opportunities between fintechs and incumbents.

Half of merchants surveyed (47%) say that working with a payment processing partner that has global reach is highly important, rising to 55% of organizations that have 1,000 or more employees. Capabilities such as local acquiring, dynamic currency conversion and direct integrations into alternative payment methods are key attributes merchants are seeking to meet the needs of international shoppers. – page 11 of report

Bluefin, a leader in encryption and tokenization technology, keeps sensitive data secure with unparalleled PCI compliance expertise across a variety of industries. Learn more about Bluefin today.

Download full report here.