Videos

Resource Center

Explore Our Newsroom

Bluefin Blog

Other Resources

API’s and SDK’s

Decryptx API

ShieldConex API

PayConex API

QuickSwipe API

Bluefin Gateway Test Card/Cases

Elavon Test Card/Cases

First Data Test Cards/Triggers

First Data Rapid Connect Test Cards/Cases

EMV GoChip SDK

PHP Class File / SDK

Bluefin .NET 4.5

SDK Hosted Payment Page

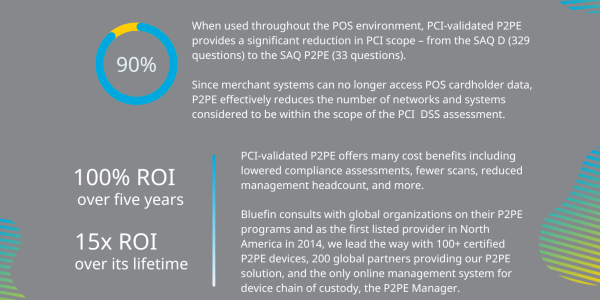

Ready to Safeguard Your Sensitive Data?

Let’s talk about how you can process, defend, and devalue sensitive information with Bluefin.