Your Payments, Your Data, Your Control

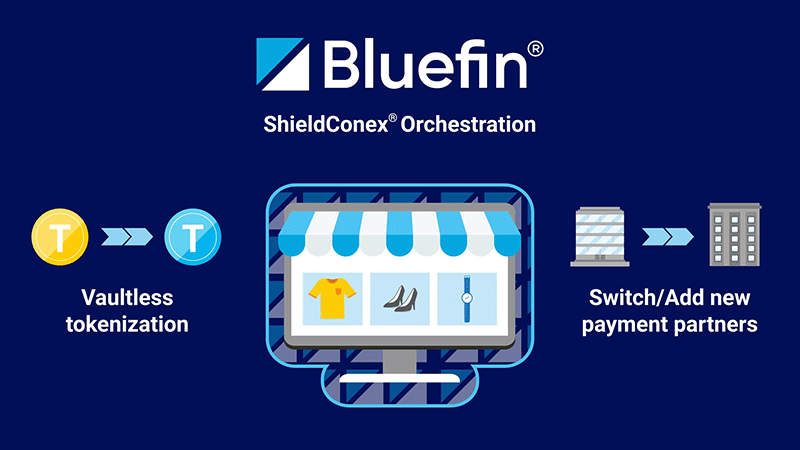

With ShieldConex® Orchestration

ShieldConex Orchestration is a processor-agnostic payment and data security platform that gives businesses full control over their payment, PII, and PHI data. With PCI-validated point-to-point encryption (P2PE) and real-time vaultless tokenization and detokenization, ShieldConex ensures secure, flexible, and scalable payment processing – without vendor lock-in.

Processor Freedom: Switch or work with multiple processors without re-keying devices or costly migrations.

End-to-End Security: PCI-validated P2PE and tokenization protect data from capture to storage.

Seamless Integration: API-driven platform connects with your existing payment processors and systems.

Multi-Channel Protection: Tokenize payments across in-store, eCommerce, and mobile transactions.

Own Your Data: Use tokens across processors and share securely with partners – no more PSP lock-in.

ShieldConex – Universal Payment Tokenization and Encryption

Supports any Bluefin EMV-certified P2PE device across processors.

Collects cardholder data online and returns universal tokens through ShieldConex iFrame.

Generates multi-processor tokens for payment, PHI, and PII data.

Ensures system compatibility with vaultless, format-preserving tokenization.

Enables safe token exchanges with partners and affiliates.

Prevents vendor lock-in with P2PE device and token portability.

The Solution for Processor Independence

Tokenization is a broad and complicated topic with many types of tokens and different token service providers. Over time, it’s common for business relationships and partnerships to change, and moving to a new tokenization service can cause disruptions. A solution that insulates merchants from tokenization changes and gives them the freedom to switch or add new payment partners at will, greatly simplifies the effort of doing business in today’s fast-paced environment.

David Mattei, Strategic Advisor, Fraud & AML practice – Datos Insights

True Payment Orchestration Flexibility

Why Choose ShieldConex Orchestration?

- Cost Optimization – Avoid high migration costs and restrictive contracts by working with multiple processors simultaneously, ensuring better rate negotiations and full control over your payment data.

- Seamless, Scalable Integration – Designed for businesses of all sizes, ShieldConex integrates with existing payment systems, reducing operational friction and enabling growth across multiple payment channels.

- Regulatory Compliance & Data Sovereignty – ShieldConex tokenization ensures sensitive data is secured in the cloud rather than on-premises, helping businesses meet data sovereignty requirements while reducing PCI compliance scope.

- The Gold Standard in Security – PCI-validated P2PE and vaultless tokenization ensure sensitive payment, PII, and PHI data remain secure across every transaction point.

Resources

THINK SHIELDCONEX ORCHESTRATION IS RIGHT FOR YOU?

Let’s connect.

"*" indicates required fields