Retail Payment and Data Security

Next-Level Payment and Data Security for Modern Retail

Bluefin’s retail payment and data processing solutions secure payments and sensitive customer data, regardless of where and how it is being accepted.

Three Paths to Retail Payment and Data Protection

Tokenization as a Service

Vaultless PCI-compliant shared tokenization solution that protects payments, PII, and PHI.

Payment Orchestration

Orchestrate payments while securing cardholder data, PII, and PHI with P2PE and vaultless tokenization.

PCI P2PE as a Service

Bluefin PCI-validated P2PE provided through partner acquirers, payment gateways, and SaaS platforms.

Integrated Retail Partners

Today’s retailers operate in a complex, omnichannel environment – point-of-sale, mobile, eCommerce, call centers, and web apps – all handling sensitive customer data. As threats evolve and compliance pressures grow, retailers need enterprise-grade payment and data security that works independently of their payment processors. Bluefin delivers with validated, scalable, and processor-agnostic solutions that secure every touchpoint while reducing PCI scope, simplifying compliance, and preserving business agility.

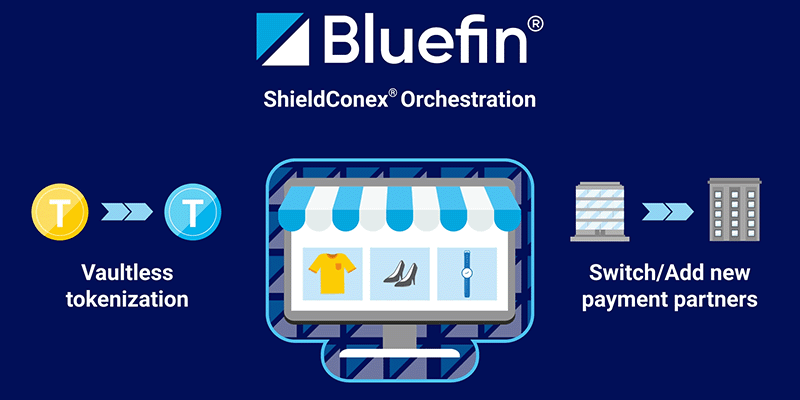

Secure and Own Your Data with ShieldConex Orchestration

ShieldConex Orchestration is Bluefin’s breakthrough platform for securing sensitive payment and personal data across every stage of the customer journey. It combines real-time, vaultless tokenization with PCI-validated P2PE, giving businesses unmatched control and flexibility without locking them into a single processor. Whether you’re safeguarding cardholder data, PII, PHI, or NACHA information, ShieldConex ensures it’s protected, portable, and processor-agnostic, so you can secure, simplify, and scale.

Why ShieldConex Orchestration for Retail

PCI P2PE

Tokenization

Agnostic Solution

Universal Tokens

Secure Data Sharing

Compliance

Secure. Simplify. Scale.

ShieldConex is designed for the realities of enterprise retail: massive transaction volumes, rapid onboarding, and seamless scaling across geographies.

Throughput

Cloud-native

Streamlined

Compatible

Meet the Bluefin team at

RetailNOW

Stop by Bluefin’s booth #240 at RetailNOW 2025 to learn more about Bluefin’s payment and data security solutions. Or book a meeting for a private demo or one-on-one consultation.

Secure Payments and Data

Let’s connect.

Learn about Bluefin’s retail encryption and tokenization solutions.

"*" indicates required fields