Retail Dive recently reported that although holiday sales will reach record highs this season, the growth rate has slowed compared to recent years. This is based on new holiday spending forecasts by the National Retail Federation (NRF).

Retail Dive recently reported that although holiday sales will reach record highs this season, the growth rate has slowed compared to recent years. This is based on new holiday spending forecasts by the National Retail Federation (NRF).

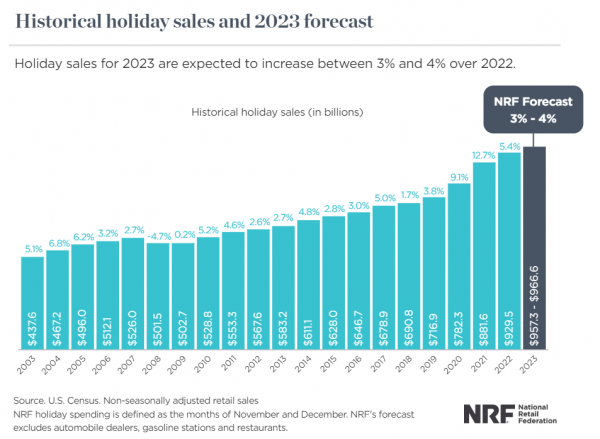

NRF predicts an overall growth rate between 3% and 4% during November and December, with total spend ranging between $957.3 billion and $966.6 billion. Online and non-stores sales are projected to reach 7%-9% with growth between $273.7 billion and $278.8 billion.

This growth is modest compared to the past three years – down from the pandemic stimulus spending that led to massive growth of 13.5% – but consistent with the average spending increases of 3.6% in years 2010 to 2019. Despite today’s economic challenges, consumer confidence remains high.

“Consumers remain in the driver’s seat, and are resilient despite headwinds of inflation, higher gas prices, stringent credit conditions and elevated interest rates. We expect spending to continue through the end of the year on a range of items and experiences, but at a slower pace. Solid job and wage growth will be contributing factors this holiday season, and consumers will be looking for deals and discounts to stretch their dollars.” – NRF Chief Economist Jack Kleinhenz.

Retailers will hire seasonal employees to meet the demands of the holiday season. While NRF expects retailers will hire between 345,000 and 450,000 seasonal workers – up from 391,000 seasonal employees in 2022, the inventory problems that have plagued nearly every industry post-pandemic have subsided.

Read full article here.