Dads. Also known as role model, volunteer coach, groundskeeper, grill master, exterminator, handyman, and ATM. Dads do it all, and expect little in return, especially when it comes to Father’s Day gifts.

It’s true that Dads have to think about non-exciting (and expensive) things like mortgages, car tune-ups, and propane tanks, so spending money for Dad is more out of necessity than it is for pleasure. But don’t tell that to the millions of consumers shopping for Dad this Father’s Day.

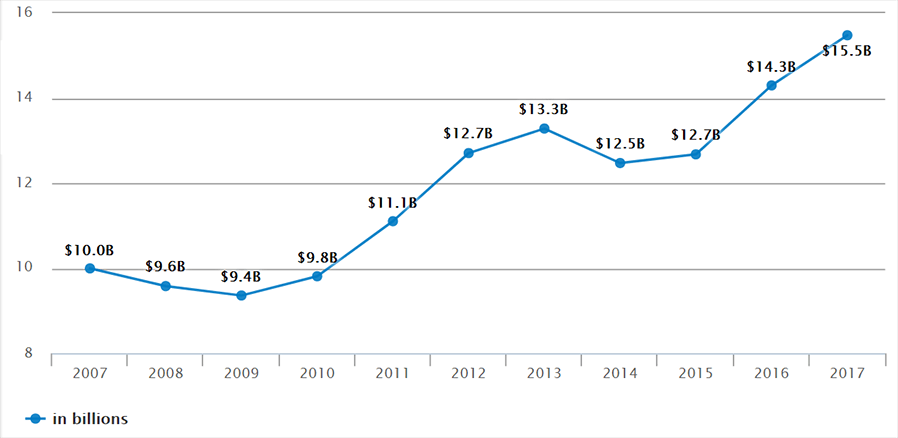

According to NRF’s annual survey, Americans plan to splurge on Dad this year and are expected to spend an average of $134.75, up from last year’s $125.92 – setting a record high in spending at $15.5 billion, topping last year’s previous record of $14.3 billion.

Planned Historical Father’s Day Spending

“It’s encouraging to see that consumers are spending on special occasions such as Father’s Day,” says Matthew Shay, president and chief executive officer, NRF. “This is a positive sign of strong consumer confidence heading into the second half of the year, and a good deal for all the dads who will reap the benefits.”

What is Dad getting this year?

NRF’s survey found that the bulk of Father’s Day spending will be on special outings, whether it be brunch or a baseball game, accounting for $3.3 billion of the spending. Greeting cards remain the most common gift, purchased by 64% of consumers, while spending on personal care items – cologne, aftershave and razors – have risen nearly 20% year-over-year, outpacing growth in every other gift category for Father’s Day. The rest of the list includes:

- Special outings, like brunch or dinner: $3.3 billion

- Gift cards or gift certificates: $2.2 billion

- Clothing: $2.2 billion

- Consumer electronics: $1.8 billion

- Personal care products: $888 million

- Home improvement supplies: $885 million

- Greeting cards: $861 million

Fathers seem to be on board with the shift from the traditional tie to an eventful outing, as the number of people opting to gift a special outing such as dinner or brunch is at 48%, up 5% from 2007. Now, 27% of dads say they would enjoy an “experience” gift and 25% of shoppers plan to buy a ticket to a concert or a sporting event for the holiday, up from 22% last year.

NRF believes millennials are responsible for the the shift in the type of gifts Dad is getting. The generation, which now has the most spending power of all age groups, reportedly prefers experiences over physical things, and they show it when it comes to buying gifts.

“That is why we are seeing a growth year over year in the category of outings, since it allows the entire family and friends to partake in the celebration and build new memories that they can share on social media and cherish for a lifetime,” NRF spokeswoman Ana Serafin Smith said.

How are consumers shopping for Dad?

Deciding on the perfect gift for Dad can be a challenge, but what about where you will find it?

While some sons and daughters are looking to score big with Dad, there are shopping tips and ideas to find the coolest gift. But being frugal still goes a long way in Dad’s book, so if you are not likely to want to spend $134.75, there are many options for gifts that are less in price but will still make Pops feel special.

Luckily, today’s consumers have many options, and NRF’s survey shows that shoppers are doing their due diligence in their research for the perfect gift. As eCommerce continues to rise, the in-store experience still holds to be important for shoppers.

“When searching for the perfect gift, 40 percent of consumers will head to department stores, 34 percent will shop online, 26 percent will shop at a discount store, 24 percent at a specialty store and 19 percent at a local small business. Among smartphone owners, 33 percent will use them to research gift ideas but only 18 percent will use them to make a purchase. Tablets are used slightly less frequently to research (32 percent) but slightly more frequently to buy (19 percent).”

Dad would want you to keep your payments secure

As the retail industry continues to change at record-speed pace, even the savviest retailer finds themselves in a world where consumer loyalty is measured in competitive prices, free delivery, excellent customer service, and let’s not forget – easy and secure payment options.

How you decide to pay for Dad’s present may be the most mundane part of the shopping experience, but as data breaches within the retail industry can attest, businesses (and consumers) need to keep payment security top of mind. Retailers of all types – eCommerce, traditional, large or small – can benefit from implementing secure payment solutions, and in today’s world, a security strategy is imperative for a retailer’s survival.

Bluefin offer a complete suite of products for today’s omni-channel retailer – including point of sale devices, mobile point of sale, call center, and kiosk or unattended – all backed by Bluefin’s PCI-validated P2PE solution. Bluefin’s P2PE encrypts cardholder data, preventing clear-text cardholder data from being present in a retailer’s system or network where is could be accessible in the event of a data breach.

Bluefin’s P2PE allows today’s omni-channel retailers to focus on their customers, and as consumers shop for Dad this week, they can rest easy knowing that their card data is safe and secure.