The Challenge Retailers Face

Retailers operate in one of the most complex payment environments today. From in-store and mobile to eCommerce and call centers, every channel introduces risk. Traditional payment orchestration platforms often fall short – they’re built for eCommerce only, don’t support card-present transactions, and fail to secure sensitive data like personal identifiable information (PII), personal health information (PHI) and payment data.

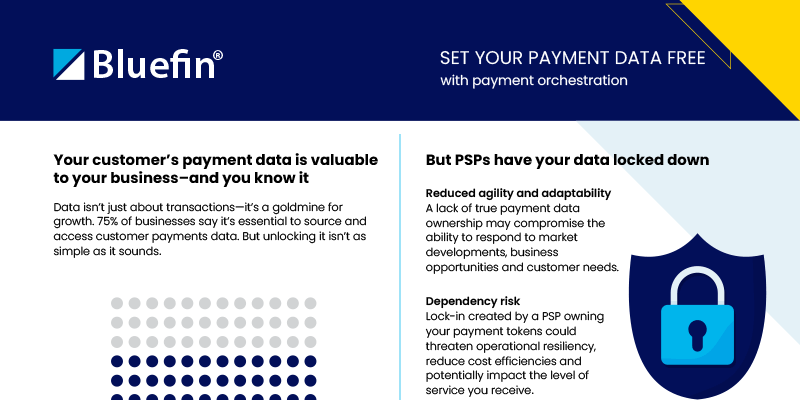

The result? Retail payment orchestration gaps remain, with issues such as vendor lock-in, unprotected entry points, fragmented customer data, and high compliance costs, all while fraud and regulatory pressure continue to grow.

Omnichannel retail payment orchestration provides merchants a smarter way to manage payments by securing every entry point, unifying fragmented customer data, and eliminating vendor lock-in. With encryption and tokenization at its core, this approach reduces compliance scope and risk while giving retailers the flexibility to scale, switch providers, and innovate with confidence.

Bluefin’s Chief Revenue Officer, Drew Monroe, explains why more companies are adopting multi-processor payment strategies and how payment orchestration turns complexity into opportunity.

Key Takeaways

- Retail payment orchestration bridges security gaps across in-store, eCommerce, mobile, and call center channels.

- Legacy platforms fall short by failing to support card-present transactions or unify customer data.

- Bluefin’s ShieldConex® Orchestration secures every entry point, reduces PCI scope by up to 90%, and gives retailers true processor freedom.

- Retailers gain flexibility, lower compliance costs, and improved fraud protection with a modern, omnichannel orchestration strategy.

Retail Payment Orchestration with ShieldConex®

That’s where ShieldConex Orchestration comes in: a purpose-built solution that applies these principles to the complex realities of modern retail. Built with PCI-validated P2PE, vaultless tokenization, and a cloud-native design, ShieldConex gives merchants full control over how they secure, route, and share payment and customer data.

Here’s how it works:

Protected Point of Entry: Data is encrypted the moment it enters through a POS terminal, mobile app, iFrame, or API with PCI-validated P2PE and vaultless tokenization in retail environments.

True Processor Freedom: Retailers control their tokens and can switch providers without costly detokenization fees.

Support for Every Transaction Type: Both in-store and eCommerce payments are supported across 120+ P2PE-enabled devices.

Unified Customer Identity: A universal token follows each customer across channels, connecting data into loyalty, CRM, and analytics platforms.

Built to Scale: A cloud-native architecture ensures low latency and global agility.

Lower Compliance Scope: ShieldConex enables retailers to streamline PCI DSS compliance, reducing scope by up to 90% while ensuring support for GDPR, CCPA, HIPAA, and NACHA.

Benefits of Retail Payment Orchestration for Retailers

By adopting ShieldConex, retailers can:

- Secure retail transactions across all channels with tokenization in retail and P2PE protection.

- Minimize compliance scope and reduce audit risk.

- Eliminate vendor lock-in while retaining control of customer data.

- Gain a unified view of customers to power loyalty and personalization.

- Scale faster without overhauling infrastructure.

In short, retail doesn’t need to get simpler – it needs to get smarter and safer. ShieldConex delivers both.

Check out some quick stats on how payment orchestration reduces complexity, increases flexibility, and provides freedom from vendor lock-in.

How Bluefin Can Help

Bluefin is a global leader in retail payment orchestration and data security. Specializing in PCI DSS compliance for retailers, we help secure billions of transactions annually with PCI-validated P2PE, vaultless tokenization, and advanced orchestration, reducing compliance scope by up to 90%.

Still have questions on why data-security matters in retail payment orchestration? Check out our FAQs below.

You can also download Bluefin’s whitepaper – Putting Data Security First in Payment Orchestration – and learn how vaultless tokenization and encryption empowers businesses to reduce vendor lock‑in, retain control of their payment data, and fuel global expansion.

Ready to protect your retail payments and customer data? Contact Bluefin today to learn how ShieldConex Orchestration can transform your approach to retail payment orchestration and secure transaction management.

Retail Payment Orchestration FAQs

What is retail payment orchestration?

Retail payment orchestration is a unified approach to managing in-store and eCommerce transactions through a single platform. It enables retailers to connect to multiple payment processors, secure sensitive data with tokenization and P2PE, and streamline compliance and routing.

Why is retail payment orchestration important for omnichannel retailers?

Omnichannel retailers need to process payments across web, mobile, in-store, and call centers. Retail payment orchestration enables a consistent, secure experience across all touchpoints while reducing vendor lock-in, improving flexibility, and centralizing data for better customer insights.

What are the most common security risks in retail payments?

Retailers face threats like card-not-present (CNP) fraud, data breaches, malware on POS systems, and phishing attacks that target employee or customer information.

How does point-to-point encryption (P2PE) protect retail transactions?

P2PE encrypts card data at the point of interaction and keeps it encrypted until it reaches a secure decryption environment, making it unreadable to fraudsters even if intercepted.

How does tokenization enhance retail payment orchestration?

Tokenization replaces sensitive card data with non-sensitive tokens. Within retail payment orchestration, this helps unify customer data across channels, reduce PCI scope, and ensure data security without storing raw card details.

How does retail payment orchestration reduce chargebacks and fraud?

By routing transactions through the most reliable processors and layering tokenization, P2PE, and fraud tools like 3D Secure, retail payment orchestration reduces false declines, improves authorization rates, and shifts liability to help prevent chargebacks.