Today’s consumers have grown accustomed to a digital, seamless world of payment options. To keep up, enterprises need the ability to accept payments across all sales channels, so partnering with a payment processing vendor that offers industry-leading capabilities is crucial.

This is easier said than done, as S&P Global Market Intelligence reports in their new study – The FAST way to evaluate merchant payment processors

“Global merchant payment processing and acquiring net revenue surpassed $91 billion in 2023 and is on pace to exceed $171 billion by 2030. This large and growing opportunity has resulted in a crowded market awash with similar vendor positioning statements. As a result, many enterprises and investors struggle to identify the capabilities that help separate leaders from laggards.” – page 1 of report.

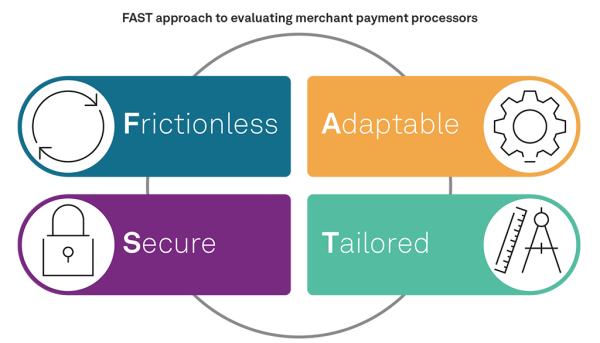

The landscape of payment processor vendors is vast, and to help their clients navigate the payment processor vendor landscape, S&P Global developed the FAST framework to assist payment technology buyers and market stakeholders in better assessing the merchant payment processor vendor landscape.

The FAST framework, composed of four categories that help to organize key capabilities and attributes, evaluates merchant payment processors, and assesses their relative strengths and weaknesses. The framework serves as a tool to evaluate vendors, understand the breadth and depth of their offerings, and assess their ability to drive business outcomes for merchant end users. The FAST framework includes:

Frictionless – Capabilities that drive improved experiences for both consumers and payments teams, such as alternative payment methods, ease of integration, global connectivity and insight that helps to identify revenue growth opportunities and optimize costs.

Adaptable – Capabilities and attributes that create efficiencies and position merchants to capitalize on market shifts and market opportunities, including uptime, scalability, optimization of transaction flow and authorizations, single platform architecture, and omnichannel payment capabilities.

Secure – Top- and bottom-line secure technology solutions that maximize successful transactions, provide fraud prevention capabilities, tools to minimize chargebacks, and solutions for data privacy and security.

Tailored – capabilities aligned with the individual business requirements and priorities of merchants, offering expertise in platform architecture, 24/7 multichannel customer support, and a robust partner ecosystem.

Bluefin – Specializes in the “S” – Security.

Best-in-class payment processing vendors will provide solutions that maximize transaction volume while minimizing fraud, but as the report states, strong security is non-negotiable when it comes to merchant payment processing.

“Data privacy and security. Capabilities that increase security and reduce compliance burden, such as vaulting, tokenization, end-to-end encryption and hosted payment pages, can add significant value for merchants. We are especially intrigued by security capabilities that drive optimizations, multiprocessor vaulting, and the ability to programmatically remove stagnant credentials. Looking ahead, increasingly on our radar will be adherence to PCI DSS 4.0, which has a looming March 2025 compliance deadline.” – page 3.

Bluefin’s integrated payment security solutions safeguard sensitive date from attacks every time your business gets paid. As the first provider of a PCI-validated point-to-point encryption (P2PE) solution in North America, Bluefin offers seamless (P2PE) technology for POS transactions and ShieldConex® – our vaultless PCI-compliant shared tokenization solution – for ecommerce payments.

Our solutions process, defend and devalue sensitive information that is exchanged, protecting customer payment data throughout the entire customer journey and delivering the benefits of PCI DSS scope reduction across all downstream channels and trusted third parties.

To keep your company safe and secure with industry-leading security solutions, contact Bluefin today.